Top Guidelines Of What Happens If I Leave a Creditor Off My Bankruptcy

Personal debt management ideas generally past a few to five years and feature modest upfront and month-to-month charges. Even so, it only performs for unsecured debt like credit cards, health-related bills and personal loans.

Additionally you could possibly be necessary to meet up with Using the folks you owe income to, and Stay underneath a courtroom-requested finances for approximately 5 several years. Which's just for starters.

SuperMoney hasn't existed provided that a lot of the referral platforms we evaluated and so there's not just as much purchaser feed-back however. This is a great way to assemble information regarding particular financial loans you might be qualified for, however , you'll nevertheless have to accomplish your software right Using the lender you decide on.

In exchange for a longer course of action, Chapter 13 bankruptcy means that you can keep your property. There's also no signifies test necessity to take advantage of this feature, as well as length of the restructured repayment expression will depend on your income stage. Nonetheless, you must comprehensive certain other necessities before you file.

By publishing this type I conform to the Terms of Use and Privateness Plan and consent to get contacted by Martindale-Nolo and its affiliate marketers, and up to three attorneys regarding this request also to receiving suitable advertising and marketing messages by automatic implies, textual content and/or prerecorded messages at the variety provided. Consent just isn't demanded as being a affliction of service, Just click here

Just make sure to substantiate that the principal cardholder normally pays punctually and maintains a very low stability relative for their credit rating limit. Otherwise, staying a certified user might not do Significantly good.

Why? Creditors that violate the automatic stay face rigid penalties. The moment they know you’ve submitted bankruptcy, most creditors will near your account, no matter your balance or payment position.

In order to avoid violating the automatic continue to be, most charge card firms will close your account when you file bankruptcy, even if your account is present-day or paid out off.

It's easier to qualify for just a Chapter i thought about this 13 bankruptcy but In such cases you should live on a rigid court docket-ordered finances and repay your debts. Not fun.

Failure to show up at the 341 hearing would not eradicate a creditor's right to object to your discharge. Most objections on the bankrupt discharge contain debts:

org differs than other companies while in the space. Credit score.org delivers an entirely cost-free own economic evaluate in conjunction with an action prepare that empowers you to make smarter choices about your choices to avoid bankruptcy. Furthermore, they will let you with the debt via reference personalised designs.

“...from the very first cell phone get in touch with I felt so relieved. Their confidence of relieving me of this stress rubbed off on me. I used to be continue to terrified and spent a lot of sleepless evenings click now worrying but calling them was the neatest thing I might have carried out.

HELOC A HELOC is a variable-price line of credit history that lets you borrow funds for any set period of time and repay them afterwards.

The sole way to halt why not try this out creditors from using motion to collect a credit card debt following a dismissed Chapter 13 circumstance is to pay the credit index card debt or re-file a brand new bankruptcy scenario.

Alisan Porter Then & Now!

Alisan Porter Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Lisa Whelchel Then & Now!

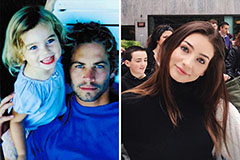

Lisa Whelchel Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!